Table of Contents

Welcome to my review of Club Cash Fun. If you’re reading this, odds are you’ve been invited into the lucrative world of MLM where all of your dreams come true. Taking the minimal effort to research such money-making opportunities is the right thing to do; after all, we’re talking about spending and making money here.

So, the question in everyone’s mind is, “Is Club Cash Fund a scam?” After reading this review, you’ll see why you should stay the hell away from this BS-spewing organization.

What is Club Cash Fund?

- Name: Club Cash Fund

- Website: clubcashfund.com

- Founder: John Stavley

- Cost: $100

- Rating: 0/10

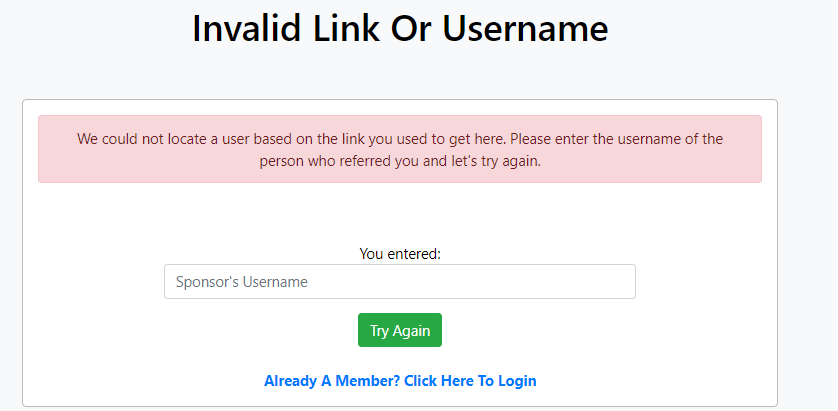

Club Cash Fund is a scheme where applicants send cash gifts through the mail. Basically, affiliates who have joined the program have to send cash or money order to the owner, John Stavley, through the mail in the hopes that they’ll receive cash from other participants later on.

The organization uses an automated system where you pretty much don’t have to do anything after sending the initial money order. The system takes care of its affiliates by automatically recording transactions and calculating how much money to send out to its people through commissions.

This company was founded by John “Chad” Stavley. The website was privately registered at the end of 2018, but the company officially launched in mid-2019. Chad has quite a lot of experience in the MLM scene, first popping up in 2010 with his affiliation with Numis Network and GiveOpp. Four years later, he appeared out of the blue with Infinite Leverage System, and in 2015, he helped relaunch the Infinite under the name Traffic Authority.

What Does Club Cash Fund Offer?

Absolutely nothing. Unlike legit MLMs, Club Cash Fund does not manufacture or retail any tangible product. Instead, your job as an affiliate is to promote Club Cash Fund’s money-making scheme to unsuspecting investors with more money than wits.

What Does It Cost to Join Club Cash Fund?

To sign up with Club Cash Fund, you first need to enclose a $100 payment and send it via mail to either Chad or one of his henchmen. Upon joining, you’ll gain access to a suite of marketing classes, which I can only assume is horsesh*it since the company doesn’t do any actual marketing (you, the affiliate, do it for them!).

Club Cash Fund also offers pro-status memberships to its affiliates who want to make more money in less time. These memberships are subscription-based, so you’ll have to continue paying every month in order to retain your rights to the fatter check bonuses. To register for pro status, you have the option of paying for the following subscription packages:

- Level 1 – $150 every month

- Level 2 – $400 for 3 months

- Level 3 – $700 for 6 months

- Level 4 – $900 for 9 months

- Level 5 – $1,000 for 12 months

How Do You Make Money with Club Cash Fund?

Here’s where it becomes 100% clear the Club Cash Fund is utter nonsense. Without any retailable goods, your job is to recruit, recruit, recruit. The only way to make a return on your investment is by convincing others into joining the cash-gifting scheme.

The $100 check that the company receives is distributed in the following manner:

- $20 goes to the referral

- $20 goes to the referral’s referral

- $20 goes to the referral’s referral’s referral

- $20 goes to the Pro Rotator (commission goes to the next person in the rotation when an applicant does not sign up through a sponsor)

- $20 goes into Chad’s fat bank account.

As for those who signed up for pro-member status, you’re entitled to the following commission rates for every pro membership you sell:

- Level 1 – $50

- Level 2 – $150

- Level 3 – $250

- Level 4 – $350

- Level 5 – $500

Spend more, potentially make more—simple as that.

Things I Like About Club Cash Fund (Pros)

Nothing. Nada. Zero pros whatsoever.

Things I Dislike About Club Cash Fund (Cons)

Now, onto more pressing matters: why Club Cash Fund sucks.

1. Unsustainable Business Model

There is no way Club Cash Fund is going to sustain for much longer. It’s abundantly clear that the company operates a pyramid scheme. Without any products for sale, the only money the company can generate is through recruiting new members. When the pool of prospective investors dries up, what’s left for the company to do? Nothing, that’s what.

2. Sending Money through Mail

Who the hell still sends money through the mail? Seriously, online payments through PayPal or Transferwise make more sense! Since the contents of the envelope are difficult to track, the sender cannot make a formal complaint against the company and ask for a refund.

Not like they’d give it to you anyway. The company’s site clearly states that any money you send is non-refundable.

3. What Marketing Classes?

It’d be nice if the company released a snippet or a preview session on what sort of marketing classes you receive upon joining. However, like most MLM companies, these training courses are designed to help those who are fully committed to the scam to promote it further. So, yes, I can only assume that there’s real value in these training courses, but you could probably receive the same information from free videos on YouTube.

Again, I can only guess, but MLM schemes typically follow a single route of scamming people out of their money, and Club Cash Fund doesn’t appear to be any different.

4. Illegal MLM Company

For an MLM company to operate legally within the US, it needs to sell tangible products. That’s why the FTC hasn’t forced Oriflame and other MLM companies to shut their doors once and for all.

In the case of Club Cash Fund, I’m guessing they haven’t attracted enough attention for the FTC to hit them with a size and desist order, otherwise the Tallahassee-based company would have been long gone.

5. Lack of Transparency

There’s hardly any information on the website regarding what the company does, who founded it, how the automated commission-calculating system works, and who receives what and when. This alone is reason enough to nope the hell out of there.

Verdict: A Pure Ponzi Scheme

Club Cash Fund is a Ponzi scheme, through and through. It isn’t even trying to pretend to be a legit MLM business, which brings scams like Tiki Profit into mind.

Being asked to send money through the mail to some stranger from across the country is a good enough reason to avoid Club Cash Fund, but for those who have already put in at least $100, you should get out while you still can.

Look, like any Ponzi scheme, it’s possible to make money. And if I’m being honest, pickings might be good right now since you may be one of the first investors who will receive commissions throughout the company’s undoubtedly short lifespan. However, it’s dirty money received through conniving tactics that Chad should be ashamed of (he’s not; this is not his first scam-filled venture).

I’m all for making money on the side, but why go to such extreme routes to do so? It’s clear that Club Cash Fund is a scam through and through, so why not focus your efforts on something more productive with the potential to make you real money?

I’m talking about affiliate marketing—not to be consumed with being an affiliate in an MLM organization. Use whatever resources you have to help companies sell their goods online. For every sale you helped create, you are entitled to a portion of the profits. It’s good money if you stick to it, and it involves minimal levels of interaction. It’s win-win for our keyboard warriors out there.

Hey, it’s Kenny here. I’m a single dad, freelance writer, an affiliate marketer. I have been making a living online since 2016, after quitting a 10-years engineering profession. When I’m not on the laptop, I’ll be in the kitchen experimenting with new cuisines.